Reason Abc Costing More Widely To Use

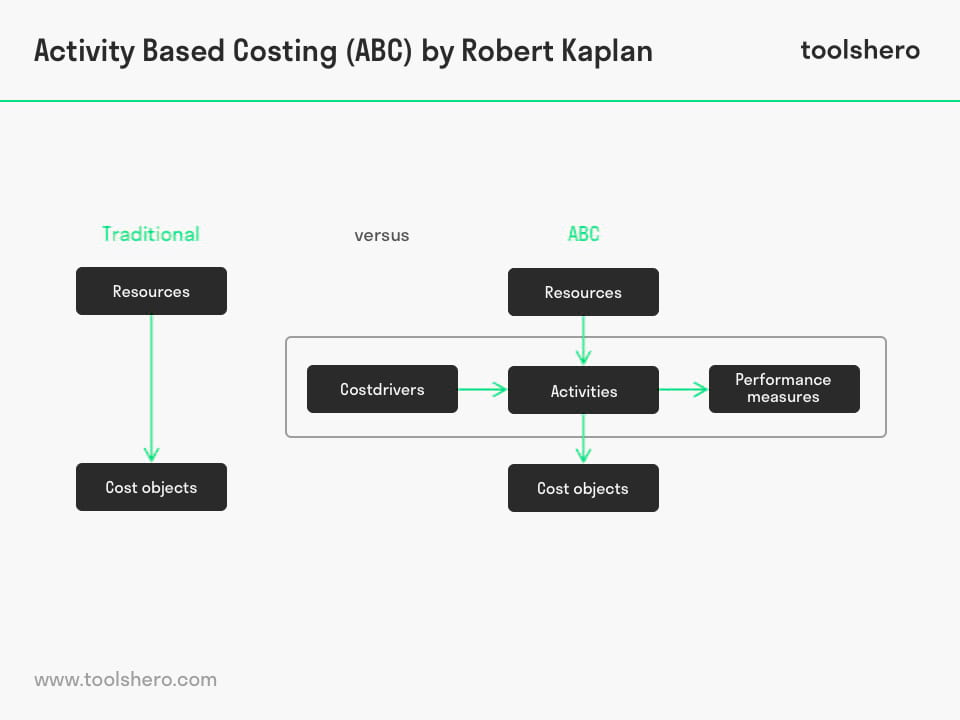

Once costs are assigned to activities the costs can be assigned to the cost objects that use those activities. In an ABC system the allocation bases that are used for applying costs to services or procedures are called A Cost Pool B Cost Driver C Cost Absorption D Cost Object Answer.

Traditional Costing Vs Abc Costing 100 Commerceiets

Although the ratio-of-costs to charges is used by a majority of provider organizations.

Reason abc costing more widely to use. Activity Based Costing ABC looks at relationships in allocating and reporting costs. Start studying Chapter 7 ABC activity based costing. It provides a more accurate cost per unit.

Because of this new understanding they are able to develop pricing strategies and marketing much more efficiently. Activity-based costing ABC is mostly used in the manufacturing industry since it enhances the reliability of cost data hence producing nearly true costs and better classifying the costs incurred. Many companies have used activity-based costing ABC in onetime profitability studies to help them decide which products or customers to cut or keep.

A major reason is that the management accounting system ideally powered using ABC principles is recalculated at frequent time intervals such as quarterly or even monthly. Costs that are caused by a group of things being made handled or processed at a single time are referred to as. Instead of just one costing such as labour hours ABC will use many costings to allocate our indirect costs.

Businesses may need to assign a team to this specific task but. However ABC systems are more complex and more costly to implement. A few of the costings that would be used under ABC include the number of machine setups the pounds of material purchased or used the number of engineering change orders the number of machine hours and so on.

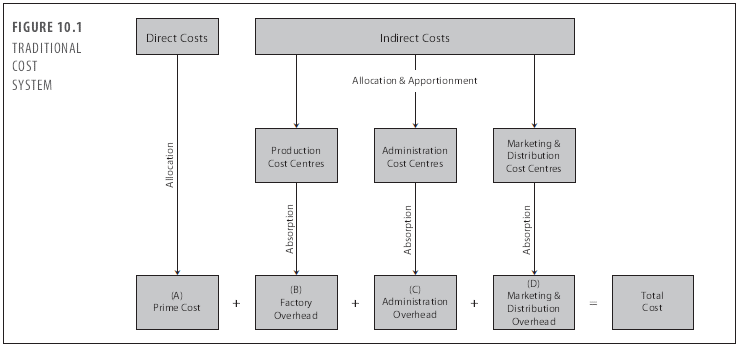

If the companys financial performance is not satisfactory it may have to resort to extreme measures like layoffs. The key difference between absorption costing and activity based costing is that while absorption costing is a way of allocating all costs to individual production units activity based costing is a way of using multiple cost drivers to allocate costs. Additionally the ABC Model can be designed to provide profit information by customer by product etc.

Activity-based costing ABC is an accounting method used to assign overhead and indirect costs to the production of goods and services. One of the main advantages of choosing to use absorption costing is that it is GAAP compliant and required for reporting to the Internal Revenue Service. Tracing of Overhead Costs.

ABC helps to reduce costs by providing meaningful information on the opportunities available for reducing costs. Consequently many of the distortions occurring in traditional cost systems are eliminated due to an itemized allocation approach. The leap from traditional costing to activity based costing is difficult.

For that reason more accurate cost allocation methods as Activity-Based Costing ABC has been introduced but seems not to be yet widely used in the textile and garment industry. Traditional Costing Advantages and Disadvantages. ABC uses multiple cost drivers many of which are transaction based rather than product volume.

Activity-based costing ABC is a methodology for more precisely allocating overhead costs by assigning them to activities. The ratio-of-costs-to-charges method the relative value unit method or the activity-based costing method. They have to go through the process of dividing products into different pools.

ABC works best in complex environments where there. Can Be Applied To The Entire Business. Some criticisms indicate that the main reason for this will be that ABC is more complex and time-consuming than traditional costing system.

Instead of calculating total costs and dividing them equally over all products team members have to evaluate the costs of each product manually. B Cost Driver Question 6. Therefore this model assigns more indirect costs overhead into direct costs compared to conventional costing.

This is essential for managers to monitor trends on costs and profit margins as operational processes and sales volume mix change. Activity-based costing ABC is a costing method that identifies activities in an organization and assigns the cost of each activity to all products and services according to the actual consumption by each. With activity-based costing the business identifies activities within the company and allocates the costs of these activities to each product and service proportionally based on an estimate of usage.

This is because they provide a more precise breakdown of indirect costs. ABC traces costs to areas of managerial responsibility processes customers departments besides the product costs. But ABC can be.

To obtain cost data needed to improve managed care decisions and negotiate profitable capitation contracts most healthcare provider organizations use one of three costing methods. Activity based costing systems are more accurate than traditional costing systems. Absorption costing and activity based costing are two widely used costing systems.

In addition ABC costing does encourage continuous improvement and total quality control because control and planning are directed at the process level and it links the corporate strategy to operational decision making. Pricing Is Better Organized With ABC businesses are able to fully identify all the costs that are associated with producing a single unit of their product. By using ABC costing we can also eliminate waste by providing visibility of non-value added activities.

The system can be employed for the targeted reduction of overhead costs. Costing principles can be used to provide information that is more relevant for managerial decision making and the effect of the new system on. It allows for deeper cost insights.

It also improves performance management policies and allows for those involved to make better decisions because their information is more accurate. Activity-based costing can be a more time-consuming process. Learn vocabulary terms and more with flashcards games and other study tools.

A Unit Level Cost. ABC helps in making the right decisions as it clearly defines the various activities. Because there is more accuracy in the costing using ABC can help provide better pricing and sales strategies.

Further ABC is concerned with all activities within and beyond the factory to trace more overheads to the products.

Activity Based Costing Abc Explanation Advantages And Tips Toolshero

Burroughs B1700 Console Would Boot The System From The Tape Cassette Computer History Old Computers System

Activity Based Cost System Abc System Cost Accounting

Pdf Activity Based Costing Abc And Its Implication For Open Innovation

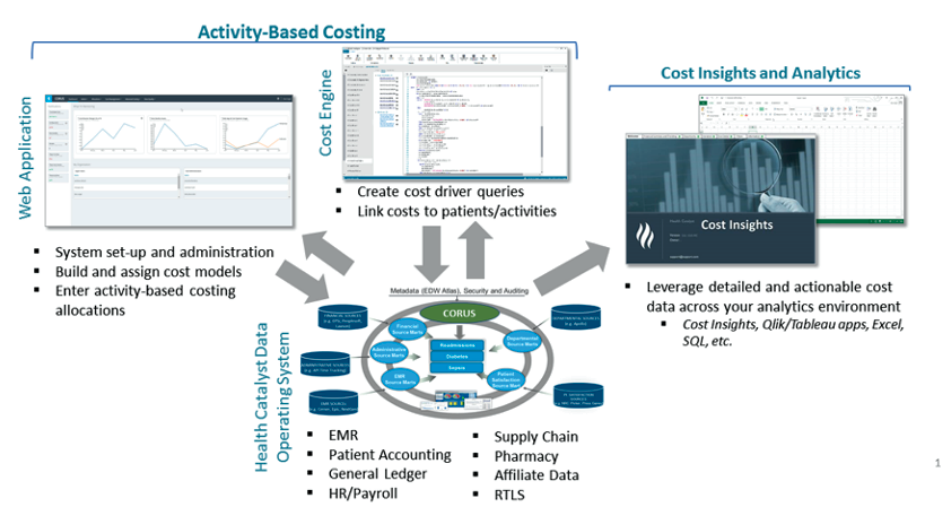

Healthcare Activity Based Costing Transforming Cost

Activity Based Cost System Abc System Cost Accounting

Posting Komentar untuk "Reason Abc Costing More Widely To Use"