The Advantanges And Disadvantages Of Traditional Costing And Abc

It offers limited accuracy even in the best of situations. Traditional costing system is likely to bring errors and approximation in product cost determination due to using arbitrary apportionment and absorption methods.

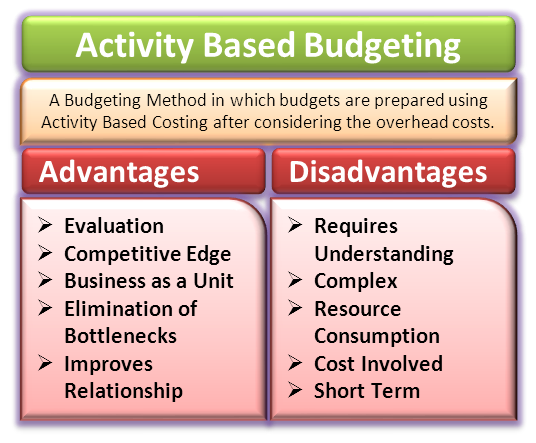

Activity Based Budgeting Need Advantages And Disadvantages Efm

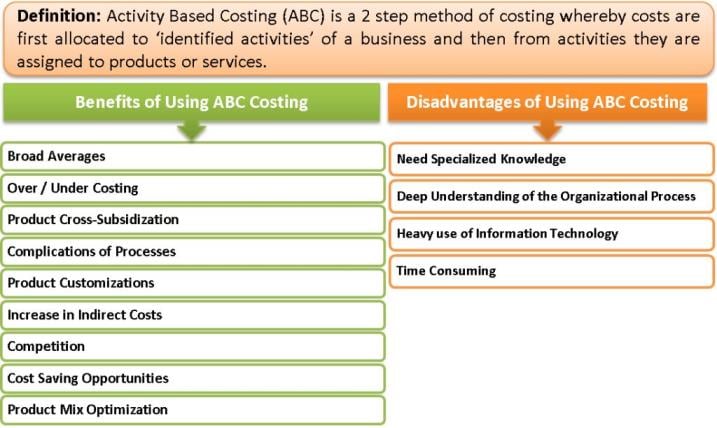

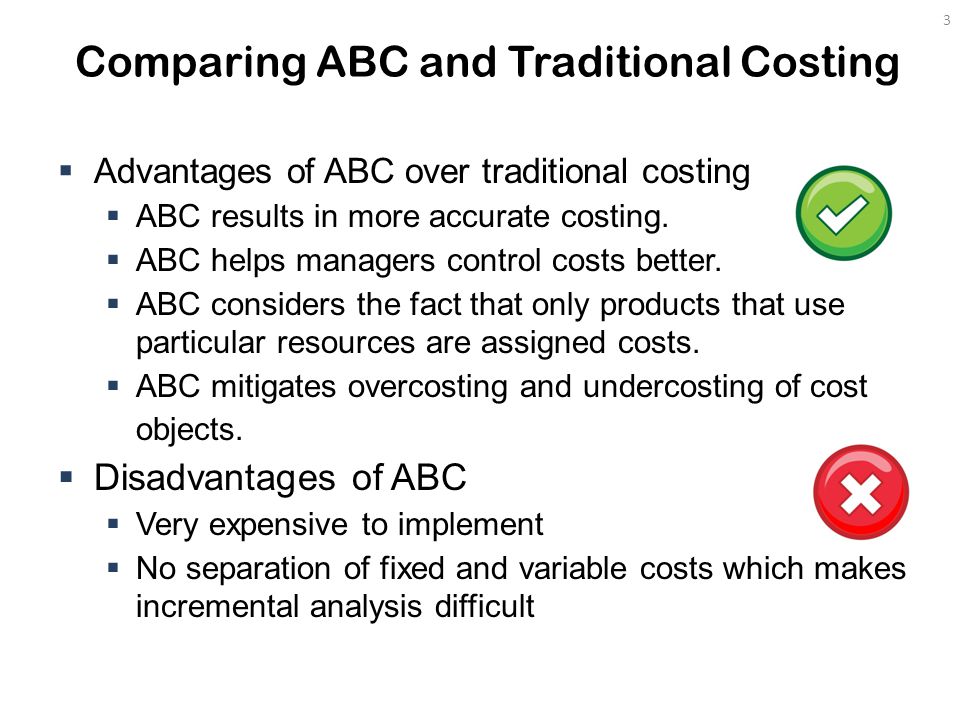

The major distinguishing features of ABC compared with traditional costing system are that ABC systems assign costs to activity cost centres rather than departments.

The advantanges and disadvantages of traditional costing and abc. While being in compliance with the principles of the GAAP conventional system the old method for costing does not include the expenses generated by customers. In the case of the Ultimate Planner that we have been discussing during this module getting all of the costs from direct materials direct labor. It is the more simplified method compared to activity-based costing.

September 8th 2021. In activity-based costing business are able to eliminate cost that are not. The Advantages of Activity Based Costing.

It is used to fix fiscal histories It shows less fluctuation in in net net income as fluctuation in gross revenues occur while the production stays the same Fixed overhead costs are included in production This method is accepted by Inland Revenue as stock is non undervalued. Advantages of activity-based accounting is that it improves the businesses process each product will have its allocated overhead cost. Here are some of the key points to consider.

Which of the following is NOT benefit of ABC. The advantages of ABC 1. It recognizes the importance of fixed costs in production is method is accepted by Inland Revenue asA stockA is non undervalued is method is ever used to prepareA financialA histories When production remains changeless but gross revenues fluctuate soaking up costing will demo less fluctuation in net net income and.

Traditional costing is more simplistic and less accurate than ABC and typically assigns overhead costs to products based on an arbitrary average rate. But direct labor hours is not a very good measure of the cause of costs in modern highly automated departments. The differences are in the accuracy and complexity of the two methods.

Reduction of prime cost is not the benefit of the activity-based costing system. Traditional costing assigns expenses to products based on an average overhead rate. Labor-related costs in an automated system may be only 5 percent to 10 percent.

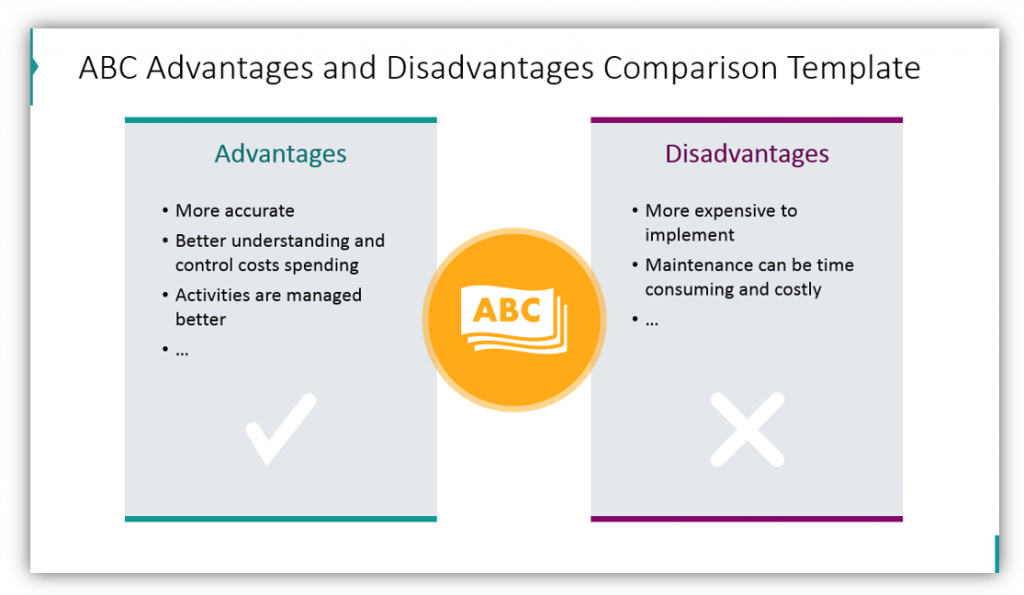

Advantages and disadvantages of ABC Advantages. It tends to distort the. List of the Disadvantages of the Traditional Costing System 1.

The use of the single cost driver does not allocate overhead as accurately as using multiple cost drivers. More overheads can be traced to the product. Product costing involves allocating costs from activity centers to products and calculating a product cost per.

It provides a more accurate cost per unit. ABC identifies the real nature of cost behaviour and helps in reducing costs and identifying activities which do not add value to the product. It also improves performance management policies and allows for those involved to make better decisions because their information is more accurate.

With ABC managers are able to. It does not offer the same accuracy when trying to look at the actual expenses that are incurred by an organization. Drury 2008 Although traditional absorption techniques may.

In the course of time the traditional method of costing has been criticized for its shortcomings and disadvantages. More realistic product costs are provided especially in industries where support overheads are a significant proportion of total costs. Because there is more accuracy in the costing using ABC can help provide better pricing and sales strategies.

So manager should use the data produced through ABC. Disadvantages of the traditional method include. As a result pricing sales strategy performance management and decision making should be improved.

Here is a look at how it works and compares to variable costing the other option. Identify and discuss at least 2 each the advantages and disadvantages of. The absorption costing method comes with several advantages and disadvantages when compared to other costing approaches.

Defects of Traditional Cost Allocation and the inception of ABC. ABC is concerned with all activities so takes product costing. Absorption costing includes full costs of production.

View ABC costing advantages LE3docx from ACC MISC at Grossmont College. Data Produced through ABC Costing System can easily misinterpret and can lead towards wrong decisions. But it also is less accurate and used less frequently because it.

The Advantages of Activity Based Costing. Illustrate the difference between traditional costing and activity-based absorption costing. Pros Explained Full Production Costs.

In the past the vast majority of departments used direct labor hours as the only cost driver for applying costs to products. One of such methods is Absorption costing and activity based costing ABC. ABC is more complex and more accurate than traditional costing.

The ABC system assigns costs to each activity that goes into production such as workers testing a product. Managers are always looking for more effective ways to figure out the cost of their products. Making possible equitable and scientific pricingby reducing prices of products that use less activity resources and increase prices of products that consume more of the firms activity resources.

Absorption costing is one of two accounting methods that companies must choose. It provides a more accurate cost per. As we discussed above it offers more information than the traditional marginal costing but comes with some limitations against the ABC method.

The activity-based costing ABC system is a method of accounting you can use to find the total cost of activities necessary to make a product. Activity Based Costing ABC Advantages and Disadvantages. It is simpler and less expensive than the alternative method of activity-based costing.

The Advantages And Disadvantages Of Traditional Absorption Costing And Activity Based Costing. These activity based costing advantages and disadvantages show that it may be an appropriate costing method at times but traditional costing methods may also be useful in some ways as well. Traditional costing is looked at to be the less accurate method in determining product costs.

Lucey lists the following Advantages and Disadvantages of Activity Based Costing ABC Lucey 2002 Advantages. The advantages and disadvantages of traditional Absorption costing techniques. Helping organizations provide value added services or top-ups to existing products on actual cost incurred basis.

It provides much better insight into what drives overhead costs. What is the difference between ABC and traditional costing. Through the years when it comes to planning Managers has developed techniques and methods of forecasting future costs.

The advantages of Absorption Costing. Adaptability of ABC Costing System is not suitable for all kind of companies because small companies have not many resources to adapt it and have too many activities but size of transactions is too low. ABC recognises that overhead costs are not all related to production and sales volume.

Information about Cost Behaviour. ABC provides a more accurate cost per unit. Traditional costing may work when there are a handful of products being manufactured with low overhead costs.

Absorption Costing system has the following chief advantages benefits. September 8th 2021.

Explaining Activity Based Costing Method In Powerpoint Blog Creative Presentations Ideas

Activity Based Costing Benefits Disadvantages Of Using Abc Costing

Chapter 3 Approaches To Budgets

Advantages Disadvantages Of Activity Based Costing With Reference To Economic Value Addition Grin

Advantages Of Activity Based Costing System

Activity Based Costing Ppt Video Online Download

Posting Komentar untuk "The Advantanges And Disadvantages Of Traditional Costing And Abc"